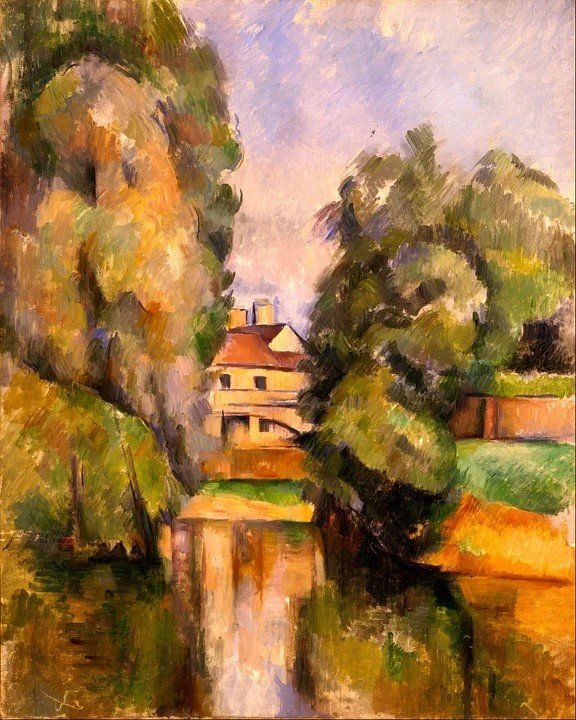

This two-part article examines the ways of transferring art without actually selling it, in order to reduce issues around tax and also to retain art within a family or some kind of structure enduring beyond the owner”s death. The article is part of a series around fine art being published this month.

Many people take pleasure in “collectibles,” perhaps even

amassing sizable and valuable collections of art, stamps and

coins, jewelry, antiques, and other forms of tangible personal

property.(1) However, despite the pervasiveness and often high

value of collectibles, owners of these items often fail to plan

adequately for their disposal. This two-part article outlines, in

part one, the options available to a collector or artist for

disposing collectibles and, in part two, highlights the benefits

of donating such items to either an operating or non-operating

private foundation. The author is Jeffrey D Haskell, with

contributions from Stephen Pappaterra.

Available Options

The first consideration is determining whether to divest oneself

of the collection during one’s lifetime or upon death. In either

case, the collector can (i) monetize the collection by selling

it; (ii) gift it to family or friends during one’s lifetime or as

an inheritance at death; or (iii) donate it, either to a publicly

supported charity or to one’s own private foundation.

Selling a collection

There may be some initial uncertainty as to the selling price of

a collection because market values fluctuate with demand, an item

or collection may be extremely rare, etc. However, once an

offering price is determined, a second key factor in selling a

collection involves tax considerations, and specifically, the

collection’s cost basis. The cost basis will depend on how the

collection was acquired:

* If the items in the collection were created by the owner, the

cost basis is the cost of the materials.

* If the collection was acquired by purchase, the cost basis is

the price paid for the collection plus subsequent capital

investments, such as restoration.

* If the collection was received by way of gift, the cost basis

is the prior owner’s cost plus subsequent capital

investments.

* If inherited, the cost basis is stepped-up to the fair market

value as of the deceased owner’s death. Any appreciation from the

date of death to date of sale is a capital gain.

A creator of the collection, or a dealer who held the collection

as inventory, will report the sale price minus the seller’s cost

basis as ordinary income (usually taxable at the highest tax

rates). If the seller did not create the work and is not a

dealer, the seller will report the sale price minus cost basis as

capital gains (usually taxable at a lower tax rate than ordinary

income). A seller who can demonstrate that he or she is a

professional collectibles investor or dealer will be able to take

a deductible loss if the sale is for less than cost basis. For

most collectors, a collection is held “for personal use,” such as

display in their homes, and no loss on a below-basis sale is

allowed. The current federal tax rates for different types of

sales of collectibles are as follows: (a) up to 37 per cent if

ordinary income or capital gain on assets held for less than one

year; (b) a flat 28 per cent on all other collectible sales plus

a 3.8 per cent Medicare surtax for certain high-income sellers.

In addition, some states may have their own tax rates on sales of

collectibles.

If the sale of the collection can be delayed until the collector

dies, and then sold soon thereafter, there will be little or no

capital gain due to the stepped-up basis at death.

Correspondingly, if the collection has depreciated prior to the

owner’s death, the collection will receive a step-down basis.

For a large estate (one that exceeds the applicable federal gift

and estate tax exemption), selling a rapidly appreciating

collection during life—even at a 28 per cent capital gain

rate—and making gift-tax–free annual exclusion gifts over time

may be preferable to paying federal estate tax at a 40 per cent

rate. Artists and collectors with illiquid estates should aim to

avoid a potential “fire sale” of a collection in order to pay

estate taxes.

Moreover, large sales from a single artist within a short time

period can reduce the value of the collection (2) and therefore

should also be avoided.

Transferring a collection

An artist or collector who wants to pass on their collection to

heirs must weigh the loss of possessing and enjoying the

collection themself with reducing their future estate tax

exposure. One solution would be to form a separate entity, such

as a limited partnership or limited liability company, with the

artist or collector owning 100 per cent of the entity and then

selling or gifting fractionalized interests in the entity to his

or her heirs. The value of the ownership interests in the

partnership or LLC that were not gifted would be included in the

artist’s or collector’s estate but would potentially be

discounted on account of their now minority interest and lack of

marketability. (After all, buyers may not line up to become

partial owners of a collection shared with strangers and/or

relatives of the collector.)

The collection could be transferred to a spouse outright or with

the direction to sell the collection without gift tax

implications. Another option would be to transfer the collection

to a trust that, if properly structured, could provide an income

stream and eliminate future appreciation from the estate.

Alternatively, a trust could be established for a surviving

spouse who can, if desired, authorize the sale of the collection.

Such a trust can ensure that the artist’s or collector’s intended

beneficiaries receive the collection itself or the proceeds from

the collection’s sale.

Donating a collection to a public charity

By donating the collection to charity, the collector could

receive both a tax benefit and leave a legacy, thereby showcasing

the collection for future generations. For income, gift, and

estate tax purposes, the charity must be a “qualified” charitable

organization.(3) In addition, to maximize the amount of a

charitable deduction for income tax purposes, the collection must

be used in a manner related to the charity’s tax-exempt purpose

(rather than sold upon receipt of the donation). For example, if

a donor donates a painting to an art museum to add to its

holdings, unless the donor knows otherwise, it may be reasonable

for the donor to assume that the painting will be put to a

related use (e.g., mounted in an exhibition, used to teach

restoration techniques, etc.).

By contrast, if the painting is sold within three years of the

contribution, part of the donor’s charitable contribution

deduction could be recaptured.(4) This can be avoided, however,

if the charity “certifies” that the property donated was intended

for a related use, but that such use is now impossible or

unfeasible. If counsel drafts the gift agreement, the donor

should ask about including a term in the agreement requiring the

charity to use the donated item(s) for an exempt purpose related

to its mission for a stated minimum period of time.

If the collection is donated to the charity upon death, there is

no capital gains tax liability (as with any gift) and no estate

tax due to the estate tax charitable deduction. If donated during

his or her lifetime, the donor avoids capital gains taxes,

removes the value of the collectibles from his or her estate, and

also receives an income tax deduction (limited to certain

percentages of adjusted gross income). The income tax deduction

for donations of art, collectibles, and other forms of tangible

personal property is limited to 30 per cent of the donor’s

adjusted gross income if the charity is a public charity or a

private operating foundation (20 per cent if a private

non-operating foundation). Any excess contributions generally can

be carried forward for five years.

A crucial aspect in donating tangible personal property is

determining its value. As with any sale, timing, demand, shifting

tastes, condition, and provenance are all contributing factors to

the collection’s stated value. The charity, as the recipient of

the gift, cannot be involved in its valuation.

For deductions greater than $5,000, the donor must file Form 8283

and include a “qualified appraisal” from a “qualified appraiser.”

Tax returns selected for audit where donated artwork is valued

greater than $20,000 or more should follow guidelines by the IRS

Art Advisory Panel. This panel will automatically scrutinize

donated artwork valued in excess of $50,000.

Donating to one’s own private foundation

For an artist or collector who wishes to transfer ownership of a

collection, a private foundation (either operating or

non-operating) offers yet another option. Unlike a publicly

supported charity, such as an art museum that depends on

fundraising for its operations, a private foundation is funded

and controlled by an individual, family, or corporation. It

therefore offers some of the benefits associated with donating to

a publicly supported charity, but with a greater level of

control. There are many reasons why an artist or collector might

want to create a private foundation:

* The donor can retain a level of control over the foundation,

including holding the collection within it. He or she can make

sure the pieces stay together, determine where, how often, and

how they are displayed, and ensure that they’re on exhibit

instead of languishing in storage.

* The art can remain a permanent holding of the foundation:

Because a private foundation can own and hold any type of asset

(unlike donor-advised funds, which typically require the donor to

sell the asset first and then donate the proceeds), the

collection can remain in the permanent possession of the

foundation.

* A foundation may hold collectibles and other tangible property

strictly as an investment (with no intention to display it

publicly). Alternatively, if the tangible property is publicly

displayed or actively used by the foundation in carrying out its

mission, the donation may be classified as a charitable use

asset. As we will explain, there are a number of advantages to

designating the contribution as a charitable use asset.

* If created during his or her or lifetime, the donor can

personally experience the joy of directly sharing the collection

with the public.

* Unlike donor-advised funds and other charitable vehicles that

typically liquidate donations of tangible property immediately

upon receipt, a private foundation can accept and hold them

indefinitely. The artist or collector therefore avoids having to

sell the collection quickly and, potentially, at distressed

prices.

* If contributed during the collector’s lifetime, the collector

receives an income tax deduction for the donation’s fair market

value, provided the foundation is an operating foundation and

that the donated tangible property is put to a related use. For a

non-operating (or grantmaking) foundation, or where the donor is

also the creator of the donated collection, the deduction is

limited to cost basis (or the lower of fair market value and

basis if the property is depreciated at the time of

donation).

* The donor can involve his or her family members in the

foundation. Not only will family members have hands-on experience

of philanthropy, but if their work is helpful and appropriate,

they can also be paid a salary that is commensurate with the

foundation’s size and the individual’s experience, time,

commitment, and responsibilities.

* Whereas a museum might want to sell off lesser examples of a

collection or even part with the collection altogether if its

curatorial priorities change, a private foundation can preserve

all options for the donor and future foundation directors. The

collection can be sustained in perpetuity, grow over time, or be

sold in part or in whole.

* Private foundations can employ a wide variety of IRS-sanctioned

philanthropic capabilities related to its mission. These might

include awarding music school scholarships to talented street

buskers, making loans to cash-strapped museums to mount new

exhibitions, or running programs that help artists inspire and

beautify their communities with public murals.

If the donor decides that setting up his or her own charitable

organization is the way to go, there are two distinct categories

of private foundations to consider: (1) non-operating foundations

and (2) operating foundations. Stay tuned for Part Two in which

we discuss these options and highlight the benefits of donating

to a private foundation.

Footnotes:

1. For a definition of tangible personal property for charitable

purposes, see IRS Pub. 526.

2. The IRS recognizes this fact and provides a “blockage

discount” in valuing collections for estate tax purposes.

3. Consult a tax advisor prior to making a donation of art or

other valuable collectible.

4. The donor would include in his or her income the deduction

originally claimed minus the basis in the property when the

contribution was made.

Jeffrey Haskell, J.D., LL.M., is chief legal officer for

Foundation Source, which provides comprehensive support services

for private foundations. Contact him at

jhaskell@foundationsource.com. Stephen Pappaterra, attorney at

law, serves as Counsel for the law firm of Earp Cohn, P.C.